What is the significance of this individual's approach to the stock market? A particular style of investing has become synonymous with a specific personality.

This individual is a prominent figure known for a distinctive and often unconventional approach to stock market analysis and investment strategies. Their public persona, including commentary and pronouncements on financial markets, has resonated with both seasoned investors and novice traders. An example of this approach might be a fervent belief in specific undervalued stocks or a particular sector, articulated through engaging presentations and public statements.

The individual's impact lies in their ability to connect with a broad audience, popularizing concepts about investments, risk-taking, and potential rewards. This approach can be beneficial through its accessibility and relatability, encouraging both active participation in the market and a deeper understanding of financial principles. Conversely, this style of investment can be risky and dependent on the specific insights of the individual. Their methods, while influential, haven't been universally celebrated, and their approach is often debated amongst financial professionals.

| Attribute | Details |

|---|---|

| Full Name | (Insert Full Name Here) |

| Profession | (Insert Profession Here) |

| Notable Public Appearances | (Insert List of Relevant Appearances) |

| Known for | (Insert Key characteristics, e.g., "unconventional investment strategies", "strong personality in commentary") |

From this framework, we can now dive into the broader analysis of investing philosophies and explore the role of media personalities in influencing market sentiment. This exploration will investigate the interplay of public perception, market trends, and economic cycles, examining the impact of this specific personality and their unique approach to investing.

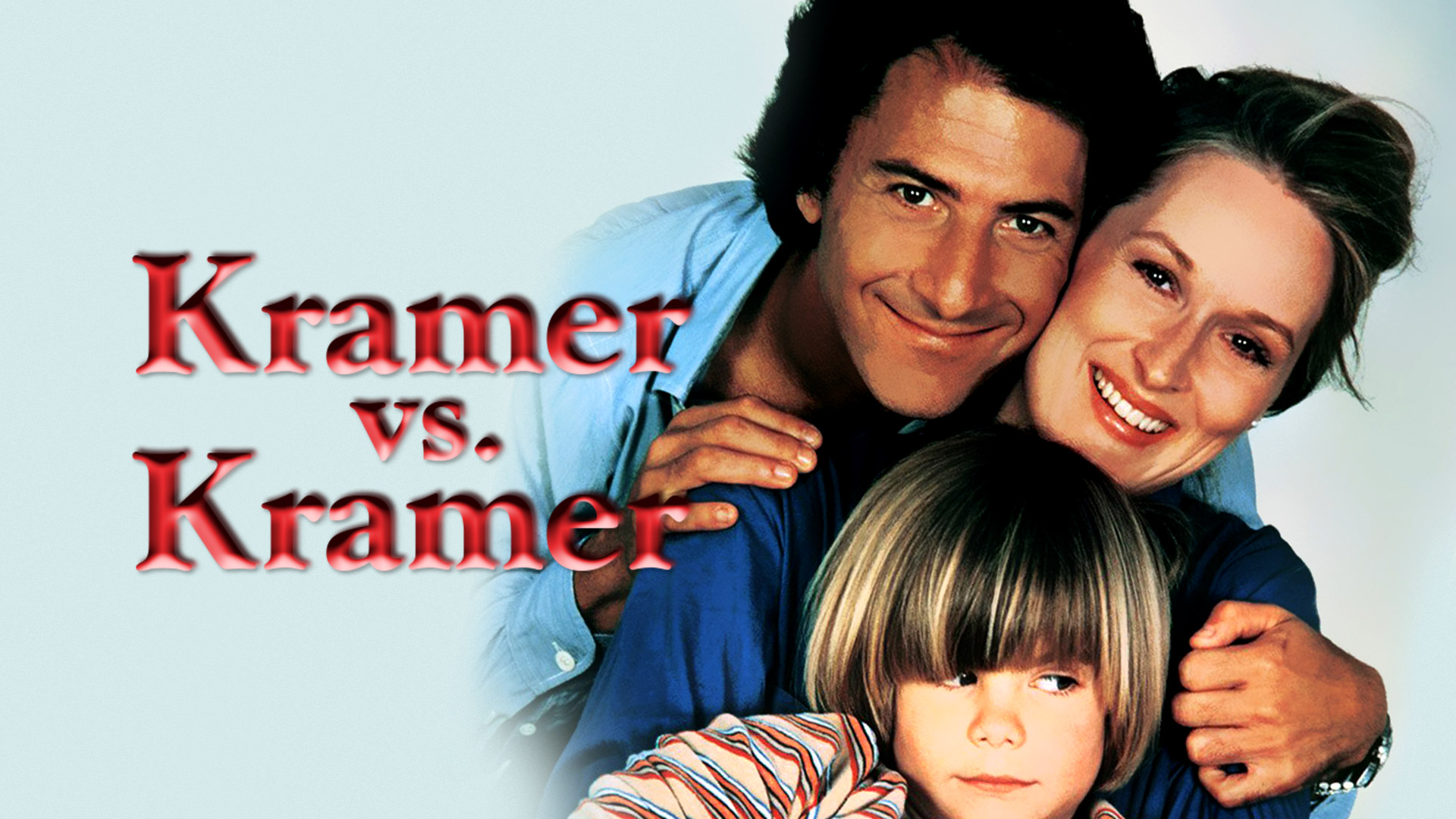

kramer stock guy

Understanding the individual's impact requires examining key aspects of their approach to the market. This involves exploring their investment strategies, public persona, and influence on broader financial discussions.

- Investment strategies

- Media presence

- Market sentiment

- Public perception

- Risk tolerance

- Stock selection

- Financial education

The aspects above contribute to a comprehensive understanding of this individual's significance. Investment strategies highlight specific approaches to the market, while media presence showcases their impact on public discourse. Market sentiment and public perception reflect the overall response to the individual's commentary and pronouncements. Risk tolerance and stock selection illustrate their investment choices, and the interplay between public perception and risk tolerance can reveal important connections. Crucially, financial education encapsulates the potential influence on viewers and market participants in the broader financial domain. For example, the individual's emphasis on particular stocks, coupled with their public persona, can profoundly affect market sentiment, creating both opportunities and risks for investors.

1. Investment Strategies

The individual's investment strategies, a core component of their public persona, deserve careful analysis. Understanding these strategies is crucial to evaluating their impact on the market and investor behavior. The strategies employed, whether conventional or unconventional, often form the basis for public discussion and analysis.

- Stock Selection Criteria

The specific criteria used for selecting stocks are key. Were these based on fundamental analysis, technical indicators, or gut feeling? The transparency or opaqueness of these criteria influences public trust and the perceived risk of following their recommendations. Examples could include specific industries or sectors targeted, or patterns of valuation emphasized. The validity and consistency of these methods should be critically examined.

- Risk Tolerance and Management

Identifying the individual's approach to risk is crucial. Are their strategies aggressive, cautious, or somewhere in between? Public pronouncements and investment track records provide evidence for assessing risk tolerance and associated management techniques. Examples could include the use of leverage, diversification strategies, and crisis responses. Examining historical data is essential for understanding their capacity to weather market volatility and their ability to articulate their risk strategy to the public.

- Market Timing and Sentiment

This individual's strategies may involve taking specific positions on market direction and public sentiment. Do they publicly express strong convictions about short-term or long-term market movements? Do their calls on market conditions often appear consistent with market trends, or do they diverge significantly? Understanding how this person interprets market timing and responds to sentiment can give insight into the approach's potential successes and pitfalls.

- Use of Leverage and Margin

The potential for using leverage and margin must be explored. Their commentary on these financial instruments and how their recommendations might involve them are factors to consider. This directly relates to the risk profile of following their advice, as higher leverage frequently corresponds to increased potential for significant losses. Examining public pronouncements about the application of such instruments is key to understanding their role in their strategies.

Overall, evaluating the investment strategies of this individual involves a critical review of their stock selection methods, risk tolerance, market timing analysis, and utilization of financial instruments. Understanding these strategies, and the rationale behind them, is fundamental for comprehending their influence on the market and, critically, on individual investors. The strategies employed, presented to the public, are part of the broader discussion around investing and risk-taking in the financial market.

2. Media Presence

The individual's media presence is a significant factor in shaping their public perception and influence on the market. This analysis explores how their engagement with various media platforms contributes to the understanding of their approach to investing and their impact on the broader financial landscape. The frequency and nature of these appearances are crucial to assessing credibility and potentially identifying biases.

- Public Appearances and Commentary

The frequency and nature of appearances across various media outlets (e.g., television, podcasts, social media) significantly impact the individual's visibility and reach. The specific content of these appearances, including their investment recommendations, market commentary, and explanations of investment strategies, directly affects market sentiment. Consistency and clarity in these statements, or a perceived lack thereof, shape public perception of the individual's expertise and reliability.

- Impact on Investor Behavior

Public pronouncements and recommendations, whether explicit or implied, can influence investor decisions. This influence extends beyond direct followers or enthusiasts to the broader market and, potentially, broader market sentiment. The potential impact includes increased market activity, potentially driven by the individual's pronouncements or interpretations, and subsequent shifts in the market's course. The mechanisms behind these impacts, both positive and negative, warrant examination.

- Presentation and Delivery Style

The style in which the individual presents themselves in the media plays a pivotal role. This encompasses verbal delivery, visual aids (if any), and overall communication. The clarity, persuasiveness, and consistency of their delivery, and any associated emotional cues or tones, shape the reception of their messages. The perception of confidence, enthusiasm, or volatility, for example, can substantially influence investor reaction.

- Media Coverage and Reporting

The nature and extent of media coverage surrounding the individual directly influence public perception. Are they featured prominently? Are critiques balanced or disproportionately focused on certain aspects? Whether supportive or critical, the coverage shapes the context in which the individual's pronouncements and actions are received, ultimately influencing investor behavior and broader market perceptions. The impact of positive and negative press coverage must be evaluated.

Examining these facets of media presence is essential for understanding the individual's overall impact. The individual's strategies, and the manner in which they are presented publicly, directly influence the understanding and reception of their pronouncements, shaping market perception and potential investor behavior. The combination of these elements further illustrates how the individual's media presence has likely contributed to their public persona and overall influence within the financial domain.

3. Market Sentiment

Market sentiment, the aggregate psychology and emotional tone surrounding investments, plays a significant role in understanding the influence of "kramer stock guy." This emotional climate, often driven by public perception and media coverage, can significantly impact stock prices and investor behavior. Examining the relationship between market sentiment and the individual's pronouncements provides crucial insights into the dynamics of the financial market.

- Influence of Public Perception

Public perception of "kramer stock guy" significantly shapes market sentiment. Positive media coverage, endorsements, and enthusiastic pronouncements can create a positive or bullish sentiment, potentially driving upward price movements. Conversely, negative commentary, criticism, or perceived inconsistencies can generate a bearish sentiment and impact investor confidence, leading to price drops. The perceived credibility and trustworthiness of the individual play a major role in the emotional impact.

- Impact of Media Coverage and Commentary

The volume and nature of media coverage surrounding the individual's pronouncements directly influence market sentiment. Prominent coverage, especially in major financial news outlets, can amplify the impact of pronouncements, whether positive or negative. The manner in which this coverage is framed, from enthusiastic to cautious, directly impacts investors' reactions. This effect underscores the crucial role of media framing in shaping the emotional atmosphere surrounding investments.

- Correlation between Pronouncements and Price Action

A critical analysis necessitates investigating the correlation between the individual's pronouncements and subsequent price action in target stocks. Does the timing of their recommendations coincide with significant price movements? Do their predictions appear to reflect genuine market insights or are they primarily driven by personal biases or hype? Examining these correlations helps evaluate the individual's influence on market sentiment and potential market manipulation. Identifying patterns can uncover the degree to which pronouncements cause price changes or are simply a reflection of pre-existing trends.

- Impact on Investor Confidence and Behavior

The individual's pronouncements and the resulting market sentiment can significantly impact investor confidence. Positive sentiment tends to fuel optimism and increased trading volume. Negative sentiment can lead to caution and decreased investment activity. Tracking the interplay between investor behavior and the individual's pronouncements allows a deeper understanding of their overall impact on the market. Analyzing investor reactions to their recommendations can reveal whether pronouncements are leading or reacting to market trends.

In conclusion, market sentiment is a crucial factor to consider when analyzing "kramer stock guy's" impact on the market. The individual's public persona, media presence, and perceived credibility play a vital role in creating market sentiment. Understanding these connections helps in assessing their impact and recognizing the intricate relationship between emotional responses, financial decisions, and market movements. The correlations between pronouncements and price action provide valuable insight, revealing potential influences beyond straightforward market analysis. The overall sentiment created and the related impact on market activity are critical to evaluating the individual's role in market dynamics.

4. Public Perception

Public perception of "kramer stock guy" is a crucial element in understanding their influence on the financial market. This perception, shaped by media portrayals, investment strategies, and individual commentary, directly affects investor behavior and market sentiment. Analyzing this perception offers insights into the complexities of market reactions and the role of personality in financial decision-making.

- Media Portrayals and Framing

Media representations significantly shape public perception. The style and tone used in news coverage, social media discussions, and other public appearances often create a narrative around the individual. Whether presented as a visionary investor or a reckless speculator, the framing determines the public's initial reaction and subsequent interpretation of their actions. Examples include the emphasis on particular investment choices, the presentation of their personal style and opinions, and the juxtaposition of success against risk in coverage.

- Investment Strategies and Outcomes

Public perception is influenced by the outcomes of the individual's investment strategies. Consistent success, even if employing unconventional tactics, fosters positive perceptions of expertise and ability. Conversely, significant losses or controversial moves can damage credibility and reputation, shifting public opinion towards skepticism or concern. This link highlights the interconnected nature of investment results and public perception.

- Individual Commentary and Personality

The individual's expressed opinions and public persona significantly influence how they are perceived. Whether the style is brash, analytical, or persuasive, the way information is delivered contributes to the public's image of their competence and reliability. The personality traits conveyed, whether enthusiasm, confidence, or volatility, impact the public's overall assessment and trust in the individual.

- Impact on Investor Behavior

Public perception acts as a filter through which investors process information and make decisions. A positive perception can attract investor interest, leading to increased demand for particular stocks or investment strategies promoted by the individual. Conversely, negative perception may lead to cautious investment or avoidance of opportunities presented. This dynamic underscores the crucial role of public opinion in influencing market activity and individual investment decisions.

Ultimately, public perception of "kramer stock guy" is a complex interplay of media representation, investment results, individual characteristics, and investor reactions. Examining these facets reveals how the public's view of the individual forms a crucial component in evaluating their impact on the broader market, highlighting the profound connections between public perception and financial markets. This process demonstrates the intricate link between individual reputation and market sentiment.

5. Risk Tolerance

Risk tolerance, a crucial component of investment strategy, is inextricably linked to the individual's approach to the market. Understanding the individual's risk tolerance profile is essential for evaluating the potential benefits and pitfalls of emulating their investment choices. The individual's public pronouncements and actions often present a particular style or level of risk. This style of risk-taking influences how investors perceive their investment recommendations. Analyzing the relationship between risk tolerance and the individual's pronouncements reveals potential correlations and the consequences associated with different approaches to market volatility.

The individual's approach to risk is often highlighted in public appearances and financial commentaries. The manner in which they discuss potential gains and losses, and the level of confidence exhibited in predictions, reveals a style of risk-taking. Are their pronouncements focused on high-reward, high-risk ventures? Or are their statements more measured and balanced, suggesting a more cautious strategy? Evaluating the associated levels of potential loss versus profit is central to assessing their overall approach to risk. Real-life examples of past investments can provide clues. Did the individual focus on volatile assets with demonstrably high reward potential? Or were their investments more consistently in established sectors with lower volatility? The context of the market at the time of these investments also needs consideration. The individual's risk-taking strategies, however, need to be viewed within a wider context, recognizing that risk assessments must account for a variety of influences, both personal and situational.

Understanding the interplay between risk tolerance and an individual's investment decisions provides investors with a crucial framework for assessing investment strategies. Recognizing and understanding the potential downsides of high-risk choices, alongside their potential for high reward, is vital. The individual's approach underscores the importance of personal risk tolerance in any investment decision. A sound investment strategy necessitates aligning personal risk tolerance with chosen investment portfolios. Overlooking this fundamental connection may lead to unintended consequences. This understanding, therefore, becomes critical for responsible and informed decision-making in financial markets. It's essential to weigh and carefully evaluate this component of any investment strategy.

6. Stock Selection

Stock selection, a core aspect of investment strategy, is central to understanding "kramer stock guy's" approach to the market. This analysis examines the characteristics and potential implications of the specific stocks highlighted or recommended by this individual. The types of stocks favored, their selection criteria, and the associated outcomes provide critical insights into their investment philosophy and potential influence on market trends.

- Specific Stock Categories Favored

Identifying the types of stocks consistently highlighted or recommended offers valuable insights. Are these primarily growth stocks, value stocks, penny stocks, or a combination? Analysis of the chosen sectorstechnology, energy, or a particular nichereveals underlying investment philosophies and potential market biases. Examples of favored sectors, if demonstrably present, could be indicators of particular beliefs about market growth in specific areas or about the potential for underestimation of certain sectors by the broader market.

- Selection Criteria and Rationale

Understanding the rationale behind stock selection is crucial. Does the individual employ fundamental analysis, technical analysis, or a combination of approaches? Are there observable patterns or criteria used to identify and select potential investments? Understanding the selection methods used provides insight into the underlying investment philosophies, motivations, and potential biases influencing recommendations. If accessible, examining the precise criteria used to identify undervalued stocks, for example, adds critical context.

- Stock Performance Outcomes and Correlations

Assessing the performance of recommended stocks over time provides context for evaluating the efficacy and consistency of the stock selection approach. Do stocks chosen tend to outperform, underperform, or mirror the market average? Analyzing historical performance patterns, particularly in relation to market cycles and broader economic trends, helps to assess the soundness of the criteria employed. Identifying correlations between the individual's recommendations and stock price fluctuations, after considering market movements, can highlight potential biases or patterns in their stock selections. Correlation analysis, however, must be mindful of potential confounding factors.

- Influence on Market Sentiment and Price Action

The impact of stock selections on market sentiment and price action merits attention. Do recommendations for specific stocks appear to coincide with price changes? Do their calls for a particular stock result in a measurable shift in the stock's trading volume, investor interest, or perceived value? An analysis of this influence involves understanding both the immediate and longer-term effects of these pronouncements on the targeted stock's value and on the broader market's perception. Understanding this relationship can illuminate the extent to which the individual has genuinely influenced markets and investor behavior, or if recommendations are simply reflecting pre-existing trends.

In summary, analyzing stock selection provides a critical lens for evaluating "kramer stock guy's" investment approach. The categories of stocks favored, the selection criteria employed, and the subsequent performance outcomes reveal insights into their investment philosophy and the degree of influence they have on market sentiment and individual investor decisions. By assessing patterns and correlations between stock selection and market reactions, a more complete understanding of their impact can be achieved.

7. Financial Education

The concept of financial education is intrinsically linked to "kramer stock guy." This individual's public pronouncements and investment strategies, whether directly or indirectly, contribute to a broader discussion about financial literacy and its importance in a market environment. Analyzing the relationship illuminates how individual actions and media portrayals can impact public understanding of investing.

- Accessibility and Availability of Information

The individual's high-profile presence and readily accessible commentary offer a unique form of financial education, albeit with varying degrees of accuracy and reliability. Broadcasting financial information through diverse media channels (social media, television) can introduce concepts like stock markets, market trends, and investment strategies to a wider audience than traditional educational channels. However, the reliability and accuracy of this information should be carefully considered.

- Impact on Public Understanding of Risk and Reward

Through actions and commentary, the individual can shape public perception of risk and reward within financial markets. The prominence of their strategies and the resulting outcomes, positive or negative, serve as examplesoften exaggeratedof the potential for both significant gains and losses in the market. This creates a lens through which individuals might perceive the risk-reward dynamic of investments. However, the examples presented might not accurately reflect the complexities of the financial world.

- Emphasis on Individual Participation and Decision-Making

The individual's approach often encourages active participation in the market. By making investments visible and engaging, they inspire potential investors to take a more direct role in financial decision-making, rather than solely relying on professional guidance. However, the potential for uninformed decision-making based on sensationalized commentary must be considered alongside this.

- Potential for Misinformation and Misinterpretation

The very nature of the individual's role as a public figure in financial matters carries a significant risk of misinformation and misinterpretation. The simplification of complex concepts and the potential for oversimplification or hype surrounding investments present a challenge to financial literacy. The importance of critical evaluation and seeking professional financial advice is thus highlighted.

Ultimately, "kramer stock guy's" role in the context of financial education is multifaceted. The individual's accessibility and prominence contribute to a wider discussion about market understanding and risk. However, the potential for misinformation and misrepresentation underscores the necessity of critical thinking and consultation with qualified financial professionals. The individual's influence is therefore a double-edged sword, simultaneously exposing more individuals to investment concepts while also increasing the risk of misinformed decisions. This emphasizes the need for further education in navigating the complexities of the market and evaluating information from various sources independently.

Frequently Asked Questions about "kramer stock guy"

This section addresses common inquiries regarding the individual known as "kramer stock guy" and their approach to the financial markets. The questions aim to clarify key aspects of their public persona, investment strategies, and the broader impact on the investment community.

Question 1: What are the primary characteristics of this individual's investment strategy?

The individual's strategy often involves focused recommendations on specific stocks, often those perceived as undervalued. A distinctive feature is a high-profile presentation style, including significant media appearances, which may amplify the impact of recommendations on market sentiment. Critical evaluation of these recommendations, and their consistent application, is necessary.

Question 2: How does media coverage influence market reactions to this individual's pronouncements?

Extensive media coverage, particularly through prominent financial news outlets, can amplify the individual's pronouncements and recommendations. This heightened visibility can directly impact market sentiment, potentially leading to substantial price movements in the targeted stocks. The framing of this coverage, whether positive or negative, substantially influences investor reactions.

Question 3: What is the relationship between this individual's personality and investor behavior?

The individual's personality, as portrayed publicly, plays a significant role in shaping investor responses. The style, whether enthusiastic or assertive, can influence trust and perception of the individual's expertise. This in turn directly impacts investor decisions and potentially affects market volatility. Assessing this influence requires careful examination of the individual's public image and its impact on market activity.

Question 4: What is the potential for misinformation or misinterpretation in the context of this individual's commentary?

The nature of public commentary necessitates a degree of caution. The simplification of complex financial concepts, often inherent in high-profile pronouncements, can lead to misinterpretations and potential misinformation. Investors must approach such commentary with critical judgment and seek professional financial advice. The potential for oversimplification, or hype, must be acknowledged.

Question 5: How does the individual's approach relate to broader financial principles?

The approach highlights aspects of active investing and the influence of individual personalities on market sentiment. However, this approach should not be considered a substitute for a broader understanding of financial markets and principles. A balanced perspective, incorporating diverse analyses and professional guidance, is crucial for sound financial decision-making.

These answers highlight the complexity of the relationship between individuals, media, and market dynamics. Critical analysis, seeking professional advice, and a balanced perspective are essential for navigating the complexities of financial markets.

Moving forward, this analysis will now delve into the practical implications and risks associated with following investment strategies based on public pronouncements.

Conclusion

This analysis of "kramer stock guy" reveals a complex interplay of individual influence, media presence, and market dynamics. The individual's high-profile pronouncements and investment strategies, often presented through media platforms, have demonstrably impacted market sentiment and investor behavior. Key elements explored include investment strategies, media influence, market sentiment, public perception, risk tolerance, stock selection, and the potential for misinformation. The analysis highlights the potential for both significant positive and negative outcomes when individuals, particularly those with a prominent public persona, offer investment advice. The individual's approach demonstrates the power of individual narratives and their influence on financial markets. However, the potential for misinterpretation, oversimplification, and the influence of hype cannot be overlooked. A nuanced understanding of the complexities underlying these dynamics is essential for informed financial decision-making.

The exploration underscores the importance of critical evaluation in assessing any investment strategy, especially those presented in a high-profile, often media-driven, manner. Investors should meticulously analyze individual strategies and outcomes, consider market context, and consult with qualified financial professionals before making investment decisions. The influence of market sentiment and personal perception necessitates a cautious approach to external recommendations. Ultimately, financial success necessitates a balanced understanding of market mechanisms, a critical approach to information, and a prudent approach to personal risk tolerance.

Christian Siriano Net Worth 2023: A Deep Dive

Tori Kelly's Rise To Fame: From YouTube To Stardom

Ramy Youssef Net Worth 2024: Updated Details