What is the significance of the personal life of a prominent financial commentator? A comprehensive understanding can illuminate broader societal and economic trends.

The personal life of a well-known financial commentator, particularly their spouse, can be a subject of public interest. This is often due to the commentator's high-profile position in the media and their frequent discussions of financial matters. Public perception and professional reputation can be influenced by aspects of their private lives. For example, if a commentator's spouse is involved in financial transactions or has a public persona, this might raise public awareness or speculation. Such developments can influence perceptions of the commentator's professional objectivity.

The intertwining of professional and personal lives in public figures like financial commentators can provide insight into societal trends. For instance, commentary on personal investments or experiences might reflect wider economic concerns and investor behaviors. An exploration of the individuals' careers and life choices may illuminate the culture of wealth, business, and investment. Understanding how these narratives intertwine allows a more nuanced perspective on the commentator's influence and the context of their commentary.

| Name | Relationship | Notable Information |

|---|---|---|

| Jim Cramer | Spouse | Information regarding the spouse's background, career, and public involvement might be relevant and will depend on individual cases |

Further research into this area could explore the broader implications of celebrity and public perception in financial commentary. Examining similar examples in other fields could uncover broader patterns in how personal lives intersect with public personas and influence public perception.

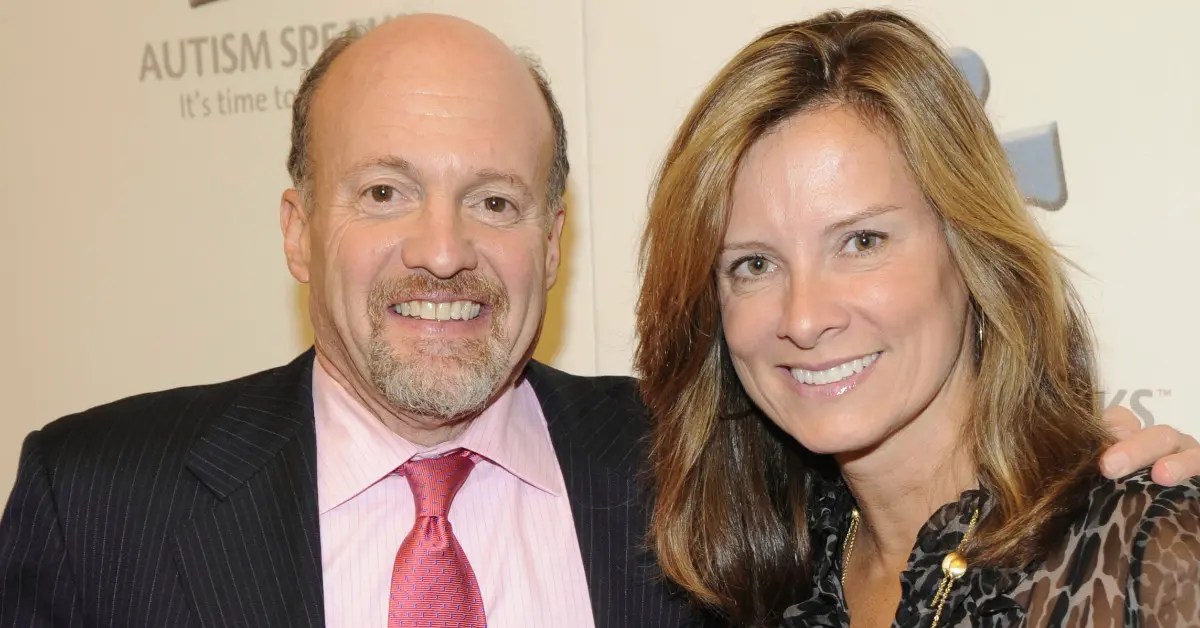

Jim Cramer and Wife

Exploring the relationship between Jim Cramer and his wife provides insight into personal lives intertwined with public figures. Understanding these aspects can illuminate public perception and broader societal trends.

- Relationship dynamics

- Public perception

- Media portrayal

- Financial influences

- Investment strategies

- Potential conflicts of interest

- Societal impact

Examining Jim Cramer's relationship through these facets reveals complexities. Public perception of the couple is shaped by media portrayal. Financial influences, both direct and indirect, are unavoidable given his profession. His wife's potential involvement in investments adds another layer of potential conflicts of interest. The societal impact of their relationship, though not directly discussed, could influence how the general public views financial advice and the professional lives of public figures. Ultimately, the significance of Jim Cramer and his wife extends beyond personal relationships to societal reflections on wealth, investment, and public image.

1. Relationship Dynamics

The dynamics of a relationship, particularly when one partner is a prominent public figure like Jim Cramer, are inherently complex. The relationship's nature, whether characterized by stability or volatility, can subtly influence public perception of the individual and potentially impact the figure's professional credibility. Public scrutiny of relationship details can generate diverse interpretations, affecting trust and confidence in the public persona. A harmonious and stable relationship might bolster perceptions of trustworthiness, while perceived discord could introduce questions about the individual's stability and objectivity. Public discourse, often fueled by media coverage, can magnify the importance of these relationships, elevating them beyond personal matters and into the realm of public interest.

Consider the effect of public perception on a financial commentator. Public perception of stability within the relationship can correlate with perceived reliability in financial commentary. Conversely, any perceived instability or conflict within the relationship might introduce an element of doubt regarding the commentator's objectivity or judgment. The influence extends beyond immediate reactions; the potential for media coverage to amplify such dynamics can substantially affect professional reputation and public trust. Real-life examples illustrate this principle, with the public reaction to reported relationship issues of prominent figures often affecting their standing in their respective fields.

Understanding relationship dynamics in the context of public figures necessitates recognizing the multifaceted nature of public perception. It underscores the complex interplay between personal lives and public personas. This awareness is essential for discerning the nuances of public trust and credibility, particularly within professions where public perception plays a significant role. Further exploration into media portrayals of relationship dynamics within such contexts can reveal patterns of influence and potential consequences. The challenge in analyzing these dynamics lies in separating personal matters from professional perceptions, recognizing that the connection exists but requires nuanced interpretation.

2. Public Perception

Public perception of individuals, particularly those in prominent roles such as financial commentators, is intrinsically linked to various aspects of their lives. The connection between public perception and the personal lives of individuals like Jim Cramer and their spouses is significant, as it can affect professional standing, credibility, and public trust. Examining this intersection offers insights into the complex interplay between personal and professional spheres within public figures.

- Media Portrayal

Media coverage, whether positive or negative, profoundly shapes public opinion. A relationship's portrayal, positive or otherwise, can impact how the public perceives the individual. Positive portrayals may enhance the perceived stability and trustworthiness of the individual. Conversely, negative portrayals may raise questions about objectivity and potentially damage the reputation of the figure. This impact is directly applicable to individuals like Jim Cramer, as media attention frequently focuses on personal and professional matters, influencing the public's perception of both.

- Relationship Dynamics

Public perception of the relationship itself is a key factor. A stable, harmonious relationship might contribute to a perception of stability and reliability. Conversely, perceived conflict or instability could raise questions about the individual's judgment and potentially compromise public confidence. The perceived strength and harmony of the relationship can have a direct influence on the public's perception of the individual's suitability to comment on financial matters or other fields.

- Financial Influences and Conflicts of Interest

If the spouse of a financial commentator has significant financial involvement or ties, public perception could be affected by potential conflicts of interest. The presence of such connections raises questions regarding potential bias and objectivity in the commentator's views. Such perceptions of financial involvement or conflict raise concerns about the impartiality of financial analysis and commentary.

- Objectivity and Credibility

Public perception is directly intertwined with the perception of objectivity and credibility. If public perception deems the individual or their relationship susceptible to bias, this impacts credibility and trust. For example, if the public perceives a conflict of interest related to the spouse's financial dealings, this directly impacts the perceived credibility of the individual's financial commentary and overall professional reputation. This nuanced perception impacts the public's willingness to accept or value the financial advice or information given by the figure.

In summary, the public perception of Jim Cramer and his spouse, or any public figure, is a complex result of intertwined factors. Media portrayal, relationship dynamics, potential financial influences, and their bearing on perceived objectivity all play a role. This underscores the significant impact personal lives can have on the public's perception of public figures, particularly in professions with high visibility and significant public impact. Further investigation into specific cases can illuminate how such factors influence public trust and the evaluation of information provided.

3. Media Portrayal

Media portrayal of Jim Cramer and his wife is a crucial component in shaping public perception. The manner in which these relationships are depicted in news articles, financial publications, and social media significantly influences public opinion. This influence extends beyond personal dynamics and directly affects professional reputation, trust, and credibility. Positive portrayals can strengthen perceived objectivity and stability, while negative depictions may erode trust and introduce questions of potential conflicts of interest or bias.

Specific examples illuminate this dynamic. If media reports highlight the couple's financial decisions or investments, the public might perceive these as potential conflicts of interest, potentially impacting the credibility of Cramer's financial commentary. Similarly, if the media portrays their relationship as stable and harmonious, the public might associate this with perceived stability and reliability in Cramer's analysis. Conversely, media portrayals of perceived discord or volatility within the relationship could cultivate suspicion, potentially jeopardizing public trust in his advice. The crucial element is not the factual accuracy of the portrayal but the perceived effect of that portrayal on the audience.

Understanding this connection between media portrayal and public perception of Jim Cramer is vital for several reasons. It underscores the significant impact of media representation on public figures. This insight is crucial for financial commentators and other public figures as it demonstrates how media choices can significantly shape perceptions and influence trust. Additionally, understanding this dynamic can help the public critically evaluate financial information and commentary. Careful consideration of the source and potential biases inherent in media portrayals is important for making informed decisions. In short, media portrayal acts as a critical lens through which the public views and assesses the credibility and trustworthiness of figures like Jim Cramer.

4. Financial Influences

The financial dealings and investments of Jim Cramer and his spouse are intrinsically linked to public perception of Cramer's commentary. Potential conflicts of interest or perceived biases arising from such influences directly impact public trust in his financial analyses. This connection warrants careful examination to assess the potential impact on the objectivity and credibility of his pronouncements.

Specific financial involvement by the spouse, such as significant investments in particular sectors or companies, could introduce potential biases. The public might perceive Cramer's recommendations as influenced by these interests, questioning their impartiality. Conversely, a lack of significant financial entanglements might enhance the perception of objectivity. The complexity lies in determining the threshold at which influence becomes significant enough to undermine public trust, a challenge often addressed through disclosure requirements and transparency in financial reporting. Past examples of financial commentators facing scrutiny for perceived conflicts of interest underscore the importance of this aspect.

Understanding this connection is crucial for both the public and financial commentators. The public benefits from recognizing potential biases in financial analyses. Commentators, in turn, must be mindful of the implications their personal financial interests may have on public perception, striving to maintain transparency and objectivity in their pronouncements. Ultimately, the interplay of financial influences and personal connections requires careful scrutiny to safeguard public trust and the integrity of financial commentary, as this directly impacts investment decisions and overall financial market confidence.

5. Investment Strategies

Investment strategies employed by individuals, particularly those with public profiles like Jim Cramer, can be viewed through the lens of potential influence. The relationship between investment strategies and individuals like Jim Cramer and their spouses becomes relevant when evaluating potential conflicts of interest, public perception, and the overall credibility of financial commentary. This exploration aims to delineate specific aspects of such connections.

- Potential Conflicts of Interest

Investment strategies adopted by Jim Cramer and his spouse might inadvertently present conflicts of interest, particularly if investments align with Cramer's publicly-expressed opinions. The public might perceive this alignment as biased commentary, potentially diminishing the credibility of his recommendations. An example might be if Cramer promotes a specific investment while his spouse holds a significant stake in the same or a similar sector. This raises questions about the objectivity of his commentary and could damage public trust.

- Influence on Public Perception

The investment strategies of Jim Cramer and his spouse influence public perception regarding his commentary. If Cramer advocates for an investment and his spouse gains significantly, the public might perceive bias, potentially diminishing the credibility of his recommendations. Conversely, a lack of apparent influence in investments might enhance public trust in his commentary. Furthermore, the strategies employed by the spouse can potentially reflect investment trends of certain demographics, adding another layer to public analysis.

- Investment Diversification and Portfolio Management

The extent to which investment strategies demonstrate diversification and portfolio management principles can inform public perception. For example, if Cramer promotes a particular type of investment without a clear demonstration of diversification within his own portfolio or his spouse's, this might raise concerns. Conversely, a demonstrably diversified portfolio, whether Cramer's or his spouse's, might reinforce perceptions of objectivity. The public often assesses the personal practice of financial commentary as a measure of its credibility.

- Transparency and Disclosure

Transparency regarding investment strategies is crucial for maintaining public trust. Explicit disclosure of the investments made by individuals in prominent roles such as Jim Cramer is important. Disclosure allows the public to assess potential conflicts of interest and evaluate the objectivity of financial recommendations. Clear communication about such strategies, if any, can help mitigate concerns and build trust in the long term.

In summary, investment strategies employed by Jim Cramer and his spouse are part of the broader context surrounding public perception of his commentary. These strategies can reveal potential conflicts of interest, influence public opinion, and impact perceptions of objectivity. Transparency and disclosure regarding investment strategies are critical for upholding public trust in financial commentary and ensuring its credibility.

6. Potential Conflicts of Interest

The potential for conflicts of interest arises when the personal financial interests of Jim Cramer and his wife intersect with his professional role as a financial commentator. Such intersections raise concerns about the objectivity and impartiality of his advice. Assessing these potential conflicts requires careful consideration of various factors, including investments, holdings, and any financial relationships between the couple and specific companies or sectors.

- Investment Overlap

Significant investment overlap between Jim Cramer and his wife in specific sectors or companies could lead to accusations of bias. If Cramer promotes investments while his spouse holds substantial positions in those same areas, public perception might question his recommendations' impartiality. This raises concerns about the integrity of his advice, as the public might suspect personal gain is influencing his commentary.

- Insider Knowledge or Information Advantages

Potential access to non-public information through the relationship, either intentionally or unintentionally shared, could introduce an insider advantage. If Cramer's wife has privileged access to information regarding a company or sector that impacts their mutual investments, this could potentially lead to a conflict of interest, undermining the integrity of his commentary. The perceived unfair advantage could severely damage public trust.

- Influence of Relationship Dynamics

The nature of the relationship itself can raise concerns about potential bias. If the relationship fosters shared financial goals or strategies, this could inadvertently lead to biased recommendations. Public perception of the couple's financial interplay might cast doubt on the independence of Cramer's analyses. The public's understanding of the influence this relationship could have on Cramer's judgment is vital.

- Disclosure and Transparency

Lack of transparency regarding the financial dealings and investments of both Jim Cramer and his wife can exacerbate concerns about potential conflicts. The public's need for clear disclosure is paramount. If financial details are not explicitly revealed, the potential for hidden conflicts and biased commentary intensifies. Adequate disclosure is essential for maintaining public trust and perception of objectivity.

The potential conflicts of interest related to Jim Cramer and his wife underscore the critical need for transparency and disclosure in professional fields like financial commentary. The public's perception of objectivity and impartiality is directly affected by such potential conflicts. Further investigation into specific instances and situations would allow a more thorough examination of the relevance and impact of these potential conflicts on public perception. Assessing the extent to which financial relationships may influence recommendations requires a nuanced approach. Ultimately, the onus is on public figures to maintain high standards of disclosure and ethical conduct to uphold public trust.

7. Societal Impact

The personal lives of prominent figures, like Jim Cramer and their spouses, can have a significant, albeit often indirect, societal impact. The interplay of professional and personal spheres in such individuals creates a ripple effect that extends beyond their immediate circles. Exploring this impact necessitates examining how public perception of such relationships might influence broader societal attitudes toward finance, investment, and public figures in general.

- Influence on Public Trust and Credibility

Public perception of Jim Cramer's professional integrity is intricately linked to the perceived stability and harmony of his relationship. Positive portrayals might enhance public trust in his financial commentary. Conversely, perceived conflict or instability could diminish that trust, potentially impacting how the public receives and interprets his pronouncements. This highlights the subtle yet substantial impact personal relationships can have on professional credibility and, by extension, public trust in financial advice.

- Effect on Media Representation of Finance

The media's coverage of Jim Cramer and his spouse frequently focuses on elements of their personal lives. This emphasis might, inadvertently or intentionally, shape public perceptions of finance more broadly. If such coverage prioritizes sensationalism or conflict, it might influence public attitudes towards the profession or specific investment decisions. The prominence afforded these relationships can also alter the public's understanding of the often complex, and sometimes precarious, nature of finance. Consequently, these portrayed dynamics could influence investment choices and market behaviors by shifting public perception.

- Setting of Societal Norms Regarding Wealth and Success

Public figures like Jim Cramer, often associated with wealth and success, can inadvertently set societal norms regarding wealth accumulation and investment. Public perception of the couple's financial practices, if portrayed prominently, can influence public aspirations or interpretations of economic success. The implications go beyond individual finance, potentially impacting societal values regarding financial goals and the definition of achievement. For instance, the media portrayal of their wealth-building strategies, whether perceived as wise or risky, can shape the general public's understanding of financial attainment.

- Impact on Financial Literacy and Public Understanding

The scrutiny placed on Jim Cramer and his spouse can elevate discussions regarding financial literacy and public understanding. If the media or public discourse emphasizes the complex elements of their relationship and financial strategies, it could inadvertently encourage broader engagement with financial concepts. This engagement, however, may or may not improve overall financial literacy. The visibility of a public figure's personal financial matters might inadvertently stimulate public interest in understanding financial complexities. Ultimately, the impact on financial literacy depends on the manner in which these relationships are presented.

In conclusion, the societal impact of individuals like Jim Cramer and their spouses is multifaceted and nuanced. By scrutinizing the coverage, public perception, and potential influences, a more comprehensive understanding of how personal relationships within prominent figures can reshape attitudes and norms in finance and wider society can be achieved. The relationship dynamic, therefore, becomes an element of public narrative influencing how wider society understands, participates in, and values financial matters.

Frequently Asked Questions about Jim Cramer and His Wife

This section addresses common inquiries regarding Jim Cramer and his spouse. The following questions and answers aim to provide factual information and context.

Question 1: What is the significance of Jim Cramer's personal life in relation to his professional career?

The intertwining of personal and professional lives of public figures can significantly impact public perception. In the case of financial commentators, details concerning personal relationships and investments can raise concerns about objectivity and potential conflicts of interest. The public often seeks to assess the impartiality of professional advice by examining the personal life of the commentator. Public perception plays a crucial role in determining the credibility and trustworthiness of financial commentary.

Question 2: How does media portrayal influence public perception of Jim Cramer and his spouse?

Media coverage significantly shapes public opinion. Positive portrayals of the couple may enhance public trust. Conversely, negative portrayals or highlighting potential conflicts of interest can erode that trust, influencing how the public perceives and evaluates Cramer's financial commentary.

Question 3: Are there potential conflicts of interest stemming from the financial dealings of Jim Cramer and his spouse?

Potential conflicts of interest arise if the financial investments or dealings of the spouse overlap significantly with sectors or companies Cramer frequently discusses. The public may perceive this as biased commentary, potentially compromising the objectivity of his financial recommendations. Transparency and disclosure are essential in such cases.

Question 4: What is the societal impact of public figures like Jim Cramer and their personal lives?

The personal lives of public figures can influence societal attitudes toward finance, investment, and public figures generally. Media portrayal of their relationships and financial strategies can shape public perceptions of wealth accumulation and investment success. Furthermore, this often influences societal attitudes regarding financial decisions and public trust in financial professionals.

Question 5: How does the discussion surrounding Jim Cramer and his spouse impact financial literacy?

The public scrutiny surrounding public figures and their relationships can stimulate discussion around financial topics and potential conflicts of interest. Increased public discourse may, or may not, enhance overall financial literacy. The manner in which the discussion is framed influences whether such scrutiny improves public understanding of complex financial concepts or exacerbates misconceptions.

In conclusion, the interplay between personal lives and professional careers of public figures like Jim Cramer often generates public interest and scrutiny. Understanding this interplay is essential for evaluating information presented by public figures and for forming informed opinions about financial matters.

This concludes the FAQ section. The next section will delve into the broader context of public figures and financial commentary.

Conclusion

The exploration of Jim Cramer and his wife's relationship reveals a complex interplay between personal life and public perception. Media portrayal, financial influences, and potential conflicts of interest are interwoven factors significantly impacting public trust in Cramer's financial commentary. The interplay between these personal elements and his professional role underscores the delicate balance between private life and public persona for prominent figures. Investment strategies employed by both individuals, and any perceived overlap, inevitably come under scrutiny, potentially affecting the objectivity and credibility of his recommendations. Ultimately, the case study illustrates how public perception and trust are intrinsically linked to the personal lives of influential figures in the financial sphere.

The scrutiny surrounding Cramer and his spouse highlights the complexities of public life. Maintaining public trust necessitates transparency and careful consideration of how personal actions and financial decisions intersect with professional responsibilities. Examining such cases offers a valuable lesson about the impact of personal lives on public perception, particularly within professions with significant influence on public decisions and investments. Further study into the dynamics between personal and professional spheres of prominent individuals can illuminate the evolving nature of trust and credibility in public life.

Bon Jovi's 2024 Net Worth: Revealed!

Dr. Jennifer Ashton: Latest Magazine Features & Insights

Terrell Williams: Latest News & Updates