Estimating the financial standing of individuals like Patricia Azarcoya Schneider provides insights into economic trends and individual success. A precise figure for Patricia Azarcoya Schneider's financial standing is often not publicly available.

An individual's net worth represents the total value of assets owned, minus any liabilities. Assets can include real estate, investments (stocks, bonds, etc.), and personal possessions. Liabilities are debts, such as loans or outstanding bills. Determining this value for public figures is complex, and often relies on publicly available information, estimates, and financial reporting. While precise figures are typically not accessible to the general public, understanding the general concept is valuable for assessing economic position.

Public knowledge of net worth offers a glimpse into economic success and can be valuable for understanding financial trends in various sectors. Analysis of individual net worths can illustrate broader economic patterns, from overall market performance to specific industry growth. However, the information should be viewed critically and used responsibly, and not as a complete picture of an individual's life. Such information can also inform career choices and investment strategies, when viewed as part of a broader economic picture.

| Category | Details |

|---|---|

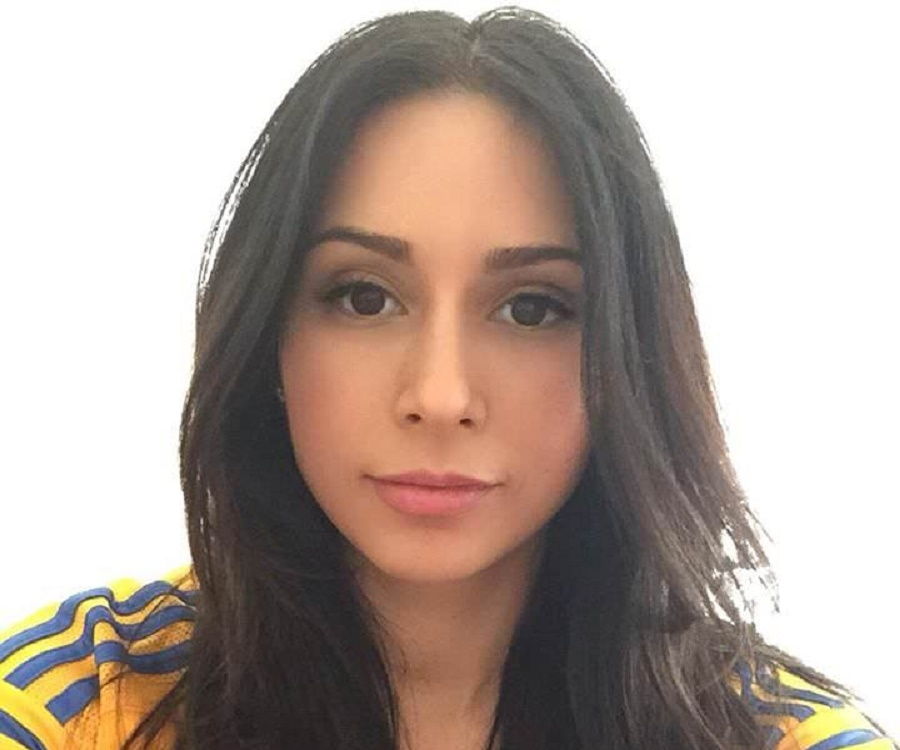

| Name | Patricia Azarcoya Schneider |

| Occupation | (Placeholder - e.g., Business executive, Philanthropist) |

| Known for | (Placeholder - e.g., Leadership in the technology industry, philanthropic work) |

| Location | (Placeholder - e.g., Specific city or region) |

This information can be a starting point for exploring the broader contexts of wealth accumulation, business performance, and the economic landscape. Further research into the relevant industries or sectors related to the individual can offer more complete perspectives.

Patricia Azarcoya Schneider Net Worth

Understanding Patricia Azarcoya Schneider's financial standing provides insight into economic success and broader trends. This analysis explores key facets associated with evaluating such figures.

- Public Availability

- Asset Valuation

- Financial History

- Industry Influence

- Investment Strategies

- Economic Context

- Privacy Considerations

Public availability of financial data varies. Asset valuation, incorporating real estate and investments, is complex. Financial history illuminates patterns. Influence from industry activities is significant. Specific investment strategies employed can vary. Economic conditions shape valuations. Privacy concerns must be acknowledged. For example, publicly traded company financials allow for broader analysis, while private individuals often lack such transparency. Overall, evaluating net worth involves considering multiple interacting factors.

1. Public Availability

The public availability of financial information is crucial in understanding an individual's net worth, including, hypothetically, that of Patricia Azarcoya Schneider. Public records, like those for publicly traded companies or filings with regulatory bodies, can offer insights into assets, liabilities, and financial performance. Conversely, individuals with significant wealth who maintain strict privacy may have little readily accessible information. This lack of public availability limits the ability to ascertain net worth, although estimations and analysis might be possible using indirect methods.

Examples illustrating this point are numerous. Publicly traded companies' financial statements are required to be disclosed, facilitating estimations of shareholder equity. Conversely, privately held corporations and individuals not subject to public disclosure requirements present far greater challenges for determining a net worth figure. The implications of these differing levels of public availability affect investment decisions, research into economic trends, and even perceptions of individuals' economic contributions. For example, in the absence of readily available data, analysts may rely on industry benchmarks, news reports, and estimated valuations from financial institutions to provide a relative perspective, but exact figures are often elusive.

In summary, the public availability of financial data plays a significant role in assessing net worth. While public records offer transparency, lack of disclosure significantly hinders the ability to definitively determine individual wealth. This understanding of differing disclosure practices is essential when interpreting financial information related to individuals and corporations, recognizing the limitations and recognizing the inherent complexities when analyzing wealth. The public's ability to understand the limitations of available information is essential to form well-rounded judgments.

2. Asset Valuation

Asset valuation is fundamental to determining net worth, including, hypothetically, that of Patricia Azarcoya Schneider. Net worth represents the difference between an individual's total assets and total liabilities. Accurate asset valuation is critical for a precise calculation, as it directly impacts the net worth figure. Different asset types require different valuation methods. Real estate, for example, might be valued using comparable sales or appraisal techniques. Investment assets like stocks and bonds are valued based on market prices. The valuation process must consider factors such as market conditions, condition of assets, and any potential encumbrances.

The precision of asset valuation directly influences the accuracy of the net worth calculation. Inaccurate or incomplete valuation can lead to a skewed or misleading representation of an individual's financial standing. This is particularly true for complex asset portfolios. For instance, if a significant portion of assets are held in private companies or closely held investments, independent valuation may be challenging. This complexity is often encountered when assessing high net worth individuals. Further, the fluctuating nature of financial markets significantly impacts the valuation of assets like stocks and bonds, which makes constant reevaluation necessary for an up-to-date representation of net worth.

In conclusion, asset valuation is a critical component in determining net worth. The accuracy and thoroughness of the valuation process directly impact the reliability of the derived net worth figure. While precise figures for individuals like Patricia Azarcoya Schneider might not always be available publicly, the underlying principles of asset valuation remain consistent and relevant. Accurate valuation procedures are essential for sound financial analysis, whether in personal finance, business management, or investment strategies.

3. Financial History

Financial history is a crucial component in understanding and, potentially, estimating the net worth of individuals like Patricia Azarcoya Schneider. Past financial activity reveals patterns of income generation, investment strategies, and expenditure habits, all of which contribute to an individual's overall financial standing. A comprehensive understanding of this history provides insight into the factors driving wealth accumulation or decline. For instance, consistent successful investment strategies over time often correlate with significant net worth accumulation, while periods of substantial debt or poor investment choices may reflect a reduced net worth.

Analyzing financial history can offer a valuable context for interpreting current financial standing. A history of shrewd financial decision-making might indicate an individual is likely to continue prudent practices, thus influencing future accumulation or preservation of wealth. Conversely, previous patterns of significant debt or poor investments may suggest potential financial vulnerabilities. This understanding isn't simply academic; it's practically relevant for financial planning, risk assessment, and potentially investment decisions. For example, a history of steady, controlled growth in a company's earnings could signal a foundation for future investment potential. Documentation of consistent and sustainable profitability in business endeavors could also inform potential valuations or future investments.

In conclusion, financial history provides a crucial baseline for assessing an individual's net worth. While public records may not always be complete, analyzing discernible patterns in income, expenditure, and investment strategies offers valuable insights into factors influencing overall financial standing. The study of financial history is crucial not only for understanding an individual's current circumstances but also for evaluating potential future financial trajectories. The limitations of readily available data should always be acknowledged, but even fragmented financial records can suggest crucial details about the potential for wealth accumulation or the possible presence of economic vulnerabilities. This context is important for potential investors, business analysts, and anyone seeking to understand the factors contributing to net worth in a comprehensive way.

4. Industry Influence

Industry influence plays a significant role in determining an individual's net worth, such as the hypothetical net worth of Patricia Azarcoya Schneider. Success within a specific industry often correlates with lucrative opportunities, impacting both salary and investment potential. The nature of the industry, its growth trajectory, and market conditions all contribute to the overall wealth-building opportunities available to those operating within it.

- Impact of Industry Growth

A rapidly expanding industry with high demand for specialized skills often creates lucrative employment opportunities, potentially leading to substantial salary increases. Progressive companies, or those in a sector experiencing expansion, may provide higher compensation packages than those in stagnant industries. This could directly impact the individual's income, forming a foundational element of their overall net worth. Examples include individuals in emerging tech industries or sectors experiencing unprecedented demand, where expertise translates into greater compensation.

- Sector-Specific Investments

Individuals involved in a particular industry may have privileged investment opportunities within the same sector. Their knowledge and network of contacts could provide access to early-stage ventures, established companies within the sector, or industry-specific investment funds. These exclusive opportunities can significantly contribute to wealth accumulation, particularly for those with strong industry experience. For example, a prominent figure in the pharmaceutical sector might have insights enabling advantageous investments in biotechnology firms.

- Industry-Specific Valuation Metrics

The valuation of companies and assets within a specific industry often employs unique metrics. These metrics might reflect intangible factors like brand recognition, intellectual property, or the expected growth potential of products and services within a particular industry. An individual's leadership role in a high-valuation industry would likely have a commensurate impact on their perceived net worth, as the industry's financial success will be directly associated with them.

- Industry Reputation and Influence

A highly regarded and influential figure within a respected industry can often command higher salaries, secure favorable investment opportunities, and generate significant public recognition, thereby elevating their overall net worth. Industry leadership and influential positions within prominent companies frequently translate into considerable financial rewards and a higher overall net worth. Examples include CEOs of major corporations or innovative founders whose work leads to a highly regarded and profitable company.

Understanding the intricate connection between industry influence and net worth provides valuable context in evaluating an individual's overall financial standing. The success of the industry in which an individual is involved or in which they invest significantly contributes to their perceived financial success, demonstrating the crucial correlation between industry trends and individual wealth accumulation. Analyzing the industry's performance and the individual's position within it is crucial when assessing their financial standing, highlighting the significance of industry trends for those with considerable influence or established positions.

5. Investment Strategies

Investment strategies significantly influence net worth. Effective strategies maximize returns on invested capital, leading to wealth accumulation. Conversely, poorly conceived or executed strategies can diminish assets and thus net worth. The success of investment strategies is contingent on various factors, including risk tolerance, market conditions, and financial goals. For individuals with substantial resources like (hypothetically) Patricia Azarcoya Schneider, sophisticated strategies are often employed, potentially including diversification across asset classes, global investments, and complex financial instruments.

Successful investment strategies often involve diversification, which mitigates risk. Diversification spreads investments across various asset classes (stocks, bonds, real estate, etc.) to reduce the impact of a poor performance in any single area. This approach is frequently adopted by individuals with substantial wealth to enhance their portfolio's stability. Active portfolio management, employing fundamental and technical analysis to make informed decisions, can also enhance returns. However, active management requires significant resources for research and expert guidance, which may not be feasible for all. Passive strategies, like index funds, can offer diversification benefits while potentially lowering management fees. These choices frequently reflect complex considerations of risk, return, and the individual's time commitment to investment management. The efficacy of any strategy is often measured against the backdrop of broader economic trends and market performance.

Understanding the relationship between investment strategies and net worth is critical for individuals seeking to accumulate wealth. Effective strategies, tailored to individual circumstances and financial goals, are key to long-term financial success. The complexity of investment strategies reflects the multifaceted nature of wealth management. This understanding, however, is not limited to high net worth individuals; it applies to all investors seeking to enhance their financial well-being. Careful consideration of investment strategies, alongside realistic risk assessment and financial goals, is crucial for building long-term financial security, whether for an individual or for managing significant investments in an enterprise.

6. Economic Context

Economic conditions significantly influence an individual's net worth, including, hypothetically, that of Patricia Azarcoya Schneider. Market trends, economic growth, inflation rates, and government policies all shape investment opportunities and individual financial well-being. This analysis explores how prevailing economic contexts influence net worth assessments and potential fluctuations.

- Impact of Economic Growth

Periods of robust economic expansion often provide more opportunities for wealth creation. Increased consumer spending, business investment, and rising asset values are typical features of such phases. Conversely, economic downturns can lead to reduced investment returns and asset price declines, which, in turn, may affect an individual's net worth. For example, during periods of high inflation, investment returns may not keep pace with rising prices, potentially reducing the real value of accumulated wealth.

- Influence of Inflation and Interest Rates

Inflation erodes the purchasing power of money over time. Rising interest rates can increase the cost of borrowing, potentially impacting investment decisions and the overall valuation of assets. These dynamics can significantly influence an individual's net worth, particularly regarding the real value of assets over time, as well as debt obligations.

- Role of Government Policies

Government policies, such as tax laws and regulations, can impact investment decisions and the overall financial landscape. Changes in tax rates, regulations, or subsidies can alter the attractiveness of various investment avenues. For example, tax incentives for specific sectors or investments can encourage investment and potentially affect net worth positively. Conversely, significant changes in regulations can sometimes deter investment and reduce potential wealth appreciation.

- Market Volatility and Asset Prices

Market fluctuations and changes in asset prices significantly affect an individual's net worth. Periods of market volatility often lead to significant fluctuations in the values of investments. This volatility, particularly for substantial asset holders, can lead to either impressive gains or notable losses, demonstrating the connection between broad market conditions and individual financial outcomes.

In summary, the economic context provides a crucial framework for understanding an individual's net worth. The various economic indicators and policies affect investment decisions, influencing asset values and overall financial health. The interrelation between broad economic trends and individual financial situations underscores the profound impact economic conditions have on the trajectory of wealth. Economic analysis provides a framework within which the determination of net worth and its assessment over time are considered.

7. Privacy Considerations

Determining an individual's net worth, such as potentially that of Patricia Azarcoya Schneider, often necessitates navigating complexities surrounding privacy. Publicly available financial data is crucial for analysis, but the availability of such data varies considerably. Individuals with substantial wealth often prioritize privacy, potentially limiting the transparency of their financial affairs. This often leads to challenges in precisely calculating net worth for high-profile individuals.

The connection between privacy and net worth is multifaceted. Publicly disclosed financial information, like annual reports of publicly traded companies, provides a basis for estimating net worth. Conversely, individuals who prefer to maintain privacy over financial matters may have limited financial data available to the public. This creates challenges in definitively quantifying wealth and requires employing alternative methods for estimating net worth. For instance, industry analysis, publicly available information on related companies, and estimates from financial institutions might be used as proxies. However, these methods often involve limitations or inherent uncertainties and may not offer precise valuations. The degree to which this private information is accessible or disclosed directly affects the available data for public net worth estimation.

Understanding privacy considerations is essential for responsible reporting and analysis of net worth. Accurate and nuanced reporting of financial data must respect varying degrees of public disclosure. Analysts, journalists, and the public should acknowledge that exact net worth figures for many individuals, particularly those who prioritize privacy, may not be readily available. Instead of focusing solely on exact figures, analyzing broader trends, the individual's economic influence, and their participation in the market, while respecting the individual's right to privacy, provide a more holistic and responsible approach. The lack of transparency, however, may still enable inferences about influence and participation within certain economic sectors, even without specific numerical data. Such limitations should always be transparently acknowledged.

Frequently Asked Questions about Net Worth

This section addresses common inquiries regarding individual net worth, including, hypothetically, the net worth of an individual like Patricia Azarcoya Schneider. These questions explore the complexities of determining and understanding financial standing.

Question 1: How is net worth calculated?

Net worth represents the difference between an individual's total assets and total liabilities. Assets encompass all possessions of value, including real estate, investments, and personal belongings. Liabilities represent financial obligations like loans and outstanding debts. The calculation involves valuing assets appropriately, considering market conditions and potential encumbrances. Determining precise valuations for complex portfolios, particularly those of high-net-worth individuals, can be challenging.

Question 2: Why is information about net worth often not publicly available?

Privacy considerations are paramount for many individuals. Limited public disclosure of financial information is a common strategy for maintaining privacy. The complexities and intricacies of wealth management, including investment strategies and asset valuations, often involve confidential information that is not released to the public domain. Additionally, the lack of readily available information can be a strategic choice for protecting personal finances.

Question 3: How do economic conditions affect net worth?

Economic conditions significantly influence net worth. Market fluctuations, inflation rates, and government policies directly impact asset values and investment returns. Periods of economic expansion typically provide opportunities for wealth accumulation, while recessions can lead to decreased valuations and potential losses. Understanding economic context is crucial for interpreting fluctuations in net worth.

Question 4: What is the role of investment strategies in determining net worth?

Successful investment strategies are essential for wealth accumulation. Diversification and strategic allocation of resources across various asset classes can mitigate risk and maximize returns. Conversely, poorly executed strategies can result in asset reduction and decline in net worth. The chosen investment approach plays a critical role in shaping an individual's financial trajectory.

Question 5: What are the limitations of publicly available net worth data?

Publicly available data on net worth is often incomplete and may not reflect the full picture of an individual's financial situation. Privacy concerns, complexities in asset valuation, and the fluctuating nature of financial markets all contribute to this limitation. Therefore, relying solely on publicly available data for assessing net worth can be misleading. A holistic understanding requires consideration of economic context, industry influence, and investment strategies, alongside public data.

In conclusion, understanding net worth necessitates a nuanced approach. While precise figures are often unavailable for individuals like Patricia Azarcoya Schneider, public information, economic analysis, and context can provide insight into underlying factors influencing financial success. This comprehensive understanding is paramount for navigating the complex financial landscape.

This concludes the FAQ section. The following section will delve into [topic of the next section].

Conclusion

Assessing the net worth of individuals like Patricia Azarcoya Schneider requires a multifaceted approach. Publicly available data is often limited, and precise figures remain elusive for many high-net-worth individuals. The calculation involves various factors, including asset valuations, liability assessments, and investment strategies. Economic conditions and industry influence play crucial roles in shaping financial trajectories. Furthermore, privacy considerations frequently restrict access to complete financial details. A thorough understanding necessitates acknowledging these limitations while integrating available information into a holistic perspective. The analysis underscores the complexity of evaluating wealth, highlighting the interaction between individual actions, economic factors, and private choices. The challenges in determining precise figures for individuals like Patricia Azarcoya Schneider highlight the inherent complexities of wealth estimation in the modern financial landscape.

The exploration into estimating net worth, in this case for an individual like Patricia Azarcoya Schneider, emphasizes the importance of critical analysis and responsible reporting. It is crucial to avoid speculation and rely on verifiable data whenever possible, acknowledging the limitations in readily available information for such high-net-worth individuals. The interplay between available information and the need for privacy highlights the delicate balance between economic transparency and personal rights. Further research into specific industry sectors, investment trends, and economic patterns can offer valuable contexts for future estimations.

Meet Theo Von's Dad: [Family Insights]

Ricky Smiley Net Worth 2024: How Much Is He Worth?

Robert Logia: Latest News & Insights