How much is this individual worth? A look at the financial standing of a notable figure.

An individual's financial standing, often expressed as net worth, reflects the total value of their assets, minus any liabilities. This figure encapsulates various holdings, including real estate, investments, and other possessions, less any debts or obligations. For example, a person with a house valued at $500,000, $200,000 in stocks, and $10,000 in savings, but with $150,000 in outstanding loans, would have a net worth of $550,000. This net worth provides a snapshot of an individual's financial position at a specific time.

Understanding net worth offers valuable insights into an individual's financial success. This information can be crucial for investment analysis, public perception of business success and performance, or as a measure of an individual's accumulated wealth. It can also be part of a larger narrative in various biographical contexts, offering a glimpse into the individual's career trajectory and overall financial performance. It is essential to note that fluctuations in asset values and liabilities can impact net worth and that the figures are often estimations.

To provide a thorough exploration of this topic, further research into the subject's financial history, career, and holdings is required. This would allow for a comprehensive and accurate analysis of the relevant financial data and provide specific examples.

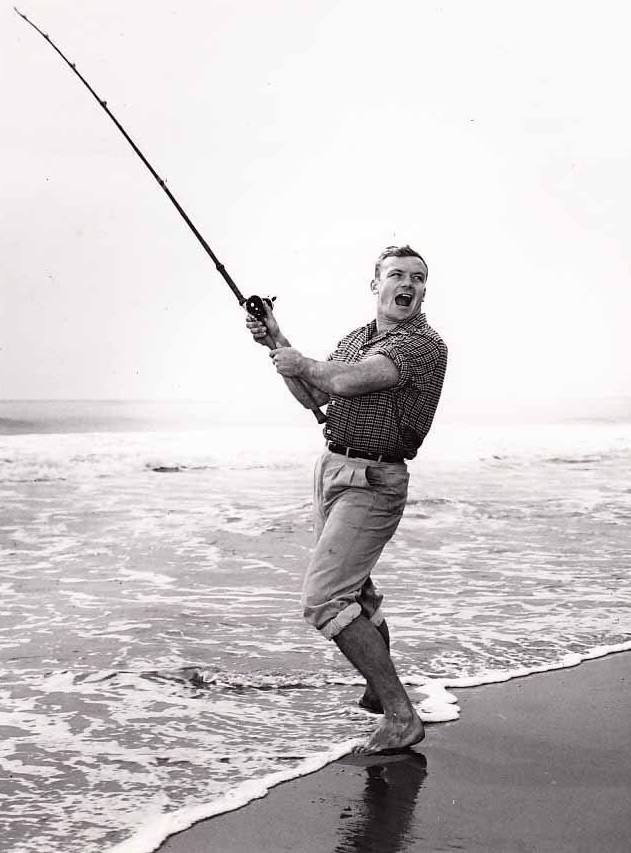

Aldo Ray Net Worth

Understanding Aldo Ray's net worth provides insight into financial success and career trajectory. Publicly available data on this figure is crucial for analysis.

- Assets

- Liabilities

- Income sources

- Investments

- Valuation methods

- Public perception

- Financial history

- Industry context

Aldo Ray's net worth is determined by the sum of his assets (e.g., property, investments) less his liabilities (e.g., loans, debts). Income sources influence this value, while investment choices and valuation methods used play a role. Public perception can affect the estimated worth if certain ventures are successful or face setbacks. A comprehensive analysis would consider his financial history, which tracks changes in his net worth over time. The industry context (e.g., entertainment, entrepreneurship) and its dynamics affect valuation and public perception. These elements combined paint a more complete picture of his financial standing.

1. Assets

Assets are the foundation of net worth. They represent a tangible or intangible possession with monetary value. For Aldo Ray, or any individual, the value of assets directly impacts the calculation of net worth. Higher-valued assets contribute to a larger net worth. This relationship is a direct cause-and-effect one. For example, owning a valuable piece of real estate increases net worth, while a substantial investment portfolio does likewise. Conversely, significant debts or losses in asset value would reduce net worth.

The types of assets held significantly influence net worth. Real estate, stocks, bonds, and other investments represent liquid and illiquid assets with varying degrees of marketability and liquidity. The diversification and types of assets held contribute to a more balanced and resilient net worth, buffering against potential losses in specific asset classes. A significant portion of Aldo Ray's assets, if available, would further illuminate the composition of their net worth, highlighting the importance of asset diversification. For instance, if a significant portion of Aldo Ray's net worth is tied to a single company's stock, a downturn in that company's value could have a disproportionate impact on their overall wealth.

Understanding the connection between assets and net worth is crucial for individuals seeking to improve their financial standing. A comprehensive evaluation of asset holdings, considering market trends, potential risks, and diversification strategies, is vital for effective wealth management. For Aldo Ray or anyone, this knowledge underscores the significance of sound financial planning. The composition of assets and their potential return, in combination with an individual's liabilities, ultimately determine their net worth.

2. Liabilities

Liabilities represent financial obligations. They directly impact net worth, acting as a counterpoint to assets. A significant portion of liabilities reduces net worth. The relationship is inverse; as liabilities increase, net worth decreases, and vice versa. This connection is crucial for understanding an individual's financial position. For example, high levels of outstanding debt, such as mortgages, loans, or credit card balances, reduce the net worth calculation. This reduction reflects the financial burden these obligations impose. Conversely, a reduction in liabilities, like paying off a loan or debt, increases the net worth figure. This demonstrates the importance of responsible financial management in positively affecting one's financial standing.

The nature and extent of liabilities significantly affect overall financial health. High levels of debt can hamper investment opportunities, limit financial flexibility, and constrain future growth. The impact of liabilities on net worth is undeniable; it underscores the importance of prudent financial decision-making. For instance, if a substantial portion of Aldo Ray's net worth is tied up in assets but accompanied by substantial loans or outstanding debts, the true net worth would be considerably lower than the asset value alone. Understanding this inverse relationship is essential for making informed financial choices. Careful management of liabilities is vital to ensuring a healthy financial position.

In summary, liabilities represent financial obligations that directly reduce net worth. The magnitude and nature of these obligations profoundly affect an individual's financial well-being. A thorough understanding of this connection is critical for sound financial planning and effective asset management. For Aldo Ray, or anyone seeking to understand their financial standing, a keen awareness of liabilities is paramount. It serves as a critical component for a balanced and accurate assessment of financial health.

3. Income Sources

Income sources are a primary driver of net worth. The amount and consistency of income directly affect the accumulation of assets. Higher and more stable income streams generally lead to increased net worth. Conversely, reduced or inconsistent income can hinder wealth growth or even result in a decline. This causal relationship is fundamental to understanding financial standing. For example, a high-earning professional with consistent income can typically afford investments and savings, contributing to a growing net worth. Conversely, intermittent or low-income levels might restrict investment opportunities and savings, limiting the ability to increase net worth.

The specific nature of income sources further influences net worth. Passive income streams, such as rental properties or dividend payouts, can augment total income and steadily contribute to wealth growth. Active income, derived from employment or entrepreneurial ventures, directly relates to current spending and investment capital. The diversification of income sources is crucial; relying on a single source leaves one vulnerable to financial shocks. For instance, an individual with several income streams, including employment, freelance work, and rental income, possesses more financial flexibility and is better equipped to weather economic downturns, thus contributing to a more resilient net worth. Furthermore, consistent income allows for more planned and strategic investments, which are key for long-term wealth accumulation.

In conclusion, income sources are essential components of net worth. The amount, stability, and diversification of income streams significantly impact wealth creation. Understanding this relationship is critical for effective financial planning and achieving financial goals. For any individual, consistent and diverse income sources are crucial for building and maintaining a healthy net worth, facilitating financial stability and allowing for investments that contribute to future growth.

4. Investments

Investments play a crucial role in shaping an individual's net worth. The decisions made regarding investments directly impact the accumulation of wealth. The return on investments, whether substantial or modest, contributes to the overall value of assets. Conversely, poor investment choices can diminish net worth. This correlation is evident in numerous real-life examples: individuals who invest wisely in diversified portfolios often experience greater wealth accumulation than those who do not.

The types of investments undertaken significantly influence net worth. Diversified portfolios, encompassing stocks, bonds, real estate, and other asset classes, generally offer better long-term returns and stability compared to concentrated investments in a single asset class. A concentrated investment strategy, while potentially lucrative in short periods, often carries higher risk and susceptibility to losses. A comprehensive understanding of market dynamics and risk tolerance is essential to making informed investment decisions. The success of investments is intricately linked to the overall financial health of an individual, influencing the growth potential of their net worth. For instance, individuals with sufficient liquid assets often possess greater flexibility in managing investment strategies and adapting to changing market conditions. Furthermore, the time horizon for investment is a critical factor; short-term investments may yield smaller returns but with less risk, whereas long-term investments, if well-managed, could generate substantial wealth over time. The potential for capital appreciation, dividends, and other returns inherent in various investment vehicles directly affects the growth of an individual's overall net worth.

In conclusion, investments are a significant component of net worth, impacting the accumulation and maintenance of wealth. Understanding the interplay between investment decisions and financial outcomes is vital for sound financial planning and growth. Successful investment strategies, coupled with a robust understanding of market dynamics, risk tolerance, and time horizons, are pivotal in achieving positive net worth growth. The direct impact of investment choices on an individual's financial standing underscores the importance of informed financial decision-making, particularly regarding asset allocation and risk management strategies.

5. Valuation Methods

Determining an individual's net worth, such as Aldo Ray's, hinges on accurate valuation methods. These methods assess the worth of assets, the fundamental building blocks of net worth. The accuracy of these methods directly affects the calculated net worth figure. Inaccurate valuations can lead to an inaccurate representation of financial standing. For example, an overvaluation of real estate holdings could inflate a net worth estimate, while an undervaluation of investment portfolios would diminish it. Consistent application of established valuation principles is essential to ensure a reliable estimate of net worth.

Different asset types necessitate different valuation techniques. Real estate often relies on comparable sales analysis, evaluating similar properties recently sold in the same area. Investment portfolios, including stocks and bonds, frequently use discounted cash flow (DCF) models or market capitalization figures. Each method's applicability and limitations must be carefully considered. For instance, a DCF model assumes future cash flows, and its accuracy is contingent on those predictions. The chosen valuation method, therefore, directly influences the net worth calculation. A nuanced understanding of the asset's specific characteristics, market context, and the valuation method's limitations helps ensure accurate representation.

Precise and consistent valuation methods are crucial for accurately reflecting an individual's financial standing. Understanding the various approaches and their inherent limitations is paramount. This ensures reliable comparisons across different individuals and allows for a more meaningful analysis of financial performance. The choice of method and its thorough application have significant implications. Accurate valuation methods are essential for sensible financial planning, informed investment decisions, and a clear picture of an individual's overall financial situation, such as Aldo Ray's. Without reliable valuation methods, any assessment of net worth becomes unreliable and potentially misleading.

6. Public Perception

Public perception plays a significant role in shaping the perceived value and, by extension, the estimated net worth of individuals like Aldo Ray. Positive public image often translates to greater perceived value, even if not directly reflected in financial figures. Conversely, negative perceptions can diminish the perceived worth, potentially impacting investment decisions and overall financial standing.

- Media Representation and Celebrity Status

Media portrayal significantly impacts public perception. Positive media coverage, endorsements, or successful ventures often enhance an individual's perceived value. Conversely, negative press or public controversies can severely damage the perceived worth, regardless of the actual financial standing. For example, a celebrity's endorsements for certain products or their public statements can influence perceptions about their financial success and thus their net worth. A change in public image due to unfavorable media reports can impact the perceived value of any associated products or services.

- Industry Reputation and Performance

Public perception is influenced by the individual's success and reputation within their industry. High levels of success, innovation, or leadership within a field often increase an individual's perceived worth. Examples include CEOs of rapidly growing companies or artists whose work gains recognition. The industry's overall health and trends also play a part. A declining industry might decrease perceived net worth even if the individual's holdings remain consistent. Therefore, factors outside an individual's direct control, such as economic conditions or industry-wide shifts, also affect public perception and the apparent value ascribed to individuals in that field.

- Social Media and Online Presence

Social media presence strongly influences public perception. A strong online persona, positive interactions with followers, or significant online following can raise an individual's perceived worth. Conversely, controversies, negative feedback, or a lack of engagement can damage that perception. The portrayal of lifestyle and accomplishments on social media platforms can impact how the public views an individual's wealth and financial success, thus influencing perceived net worth.

- Financial Performance and Transparency

Public perception of financial performance plays a crucial role. Transparent financial reporting or visibly successful ventures can enhance the perceived value, whereas undisclosed financial issues or controversies can negatively impact the perceived net worth. Consistent successful business performance, publicly recognized investments, and philanthropic endeavors are all factors that positively contribute to public perception and the estimation of an individual's net worth.

In summary, public perception acts as a powerful lens through which individuals are viewed, significantly influencing the perceived value of someone like Aldo Ray. The interplay of media representation, industry reputation, social media presence, and financial transparency creates a complex dynamic impacting the estimation of net worth, often exceeding the purely financial evaluation. Public perception is a crucial factor that needs to be considered alongside financial data when assessing the overall valuation of an individual.

7. Financial History

Financial history provides crucial context for understanding an individual's net worth. It offers a detailed account of past financial activities, including income sources, investment decisions, and spending patterns. This historical record provides insights into the factors that have shaped current financial standing, illustrating the evolution of wealth accumulation or decline over time. The study of financial history is essential to comprehend the current net worth and project future potential for an individual like Aldo Ray.

- Income and Earnings History

Income trajectory over time offers significant insights. A consistent upward trend in income often reflects a successful career path or entrepreneurial growth. Conversely, periods of declining income might indicate career shifts or economic hardship. Analysis of income sources, their stability, and growth provides crucial information for assessing the sustainability of financial performance and potential future earning capacity. This history illuminates the individual's capacity to generate and maintain income. For instance, if Aldo Ray's history shows periods of high income followed by a significant downturn, a detailed analysis of those periods is essential for assessing the overall financial stability.

- Investment Decisions and Portfolio Performance

Tracking investment decisions and outcomes over time reveals investment strategy. The nature of past investments and their returns highlight risk tolerance and investment acumen. Analysis of portfolio performance across various market cycles reveals an individual's ability to adapt to market changes, demonstrating resilience or vulnerability. Historical investment returns furnish insights into the composition and performance of investment portfolios. This is critical when evaluating Aldo Ray's net worth as it suggests patterns and strategies, showcasing capacity for growth or resilience to loss.

- Debt Management History

A thorough review of debt management reveals how an individual has managed financial obligations. A history of high debt levels and difficulty in repayment suggests potential financial vulnerabilities. Conversely, consistent debt reduction demonstrates prudent financial management. The debt-to-asset ratio over time reveals insights into financial leverage and the individual's capacity to manage debt. Understanding Aldo Ray's history with debt, if available, sheds light on how these factors might influence or impact their present financial standing and future financial potential.

- Major Financial Events and Decisions

Key financial events, such as major purchases, large investments, or financial setbacks, significantly shape an individual's financial narrative. Thorough analysis of these events provides a context for understanding the current financial standing. Reviewing major financial events helps identify the influence of significant decisions on Aldo Ray's net worth. The impact of such events on net worth can be observed, providing context for the current financial position.

A detailed examination of Aldo Ray's financial history, if accessible, is essential for a comprehensive understanding of their net worth. It provides a complete picture, revealing patterns in income generation, investment strategies, and debt management, potentially offering valuable insights into the factors influencing current financial stability. Analyzing the interplay of these elements offers a more nuanced perspective on the complexities of Aldo Ray's financial position, thereby assisting in projecting future potential and understanding the evolution of their accumulated wealth.

8. Industry Context

Industry context significantly influences an individual's net worth. The specific sector in which an individual operates often dictates income potential, investment opportunities, and overall financial stability. This context, therefore, plays a crucial role in understanding the factors shaping an individual's financial standing. For example, an individual in a rapidly growing industry may experience higher income and greater investment opportunities compared to one in a stagnating sector.

- Income Potential and Compensation Structures

Industries vary widely in compensation structures. High-growth sectors, such as technology or renewable energy, often offer higher salaries and performance-based incentives. Conversely, industries with stagnant or declining revenue may result in lower average compensation. Understanding the typical salary ranges and compensation models within an industry provides context for evaluating potential income levels and, subsequently, the potential for wealth accumulation. For instance, professionals in the technology industry might command significantly higher incomes compared to those in retail, directly affecting their capacity to build wealth.

- Investment Opportunities and Trends

Specific industries present unique investment opportunities. Sectors with significant capital expenditures, such as infrastructure or manufacturing, may attract substantial investments. Conversely, sectors facing consolidation or decline might present limited investment opportunities or entail higher risks. Understanding industry trends and investment opportunities provides context for comprehending potential returns on investment and the associated risks, which directly impact net worth. For example, the booming e-commerce sector presents numerous investment opportunities in related logistics or software, while a declining manufacturing sector might offer fewer attractive investment options.

- Regulatory Environment and Economic Factors

Industry regulations and macroeconomic conditions significantly influence financial performance. Stringent regulations or economic downturns can negatively affect industry profitability, directly impacting the potential for wealth generation. Conversely, supportive government policies or favorable economic climates can promote sector growth and enhance the potential for wealth creation. Understanding the regulatory environment and economic conditions surrounding a particular industry is critical for assessing the risks and opportunities involved. For instance, stricter environmental regulations may incentivize investments in sustainable energy solutions, potentially increasing opportunities in that industry.

- Competition and Market Dynamics

Industry competition influences the financial success of individual businesses and, consequently, the net worth of key players. Highly competitive sectors might result in lower profitability margins or necessitate significant investments in research and development. Conversely, less competitive sectors may offer higher potential for profits. The overall market dynamics and competitive landscape shape industry-wide performance, thus influencing the potential for individual wealth creation. This means understanding market share, pricing strategies, and the presence of dominant players is essential.

In conclusion, understanding the industry context surrounding an individual is vital to evaluating their financial standing. The industry's income potential, investment landscape, regulatory environment, and competitive dynamics provide a framework for understanding the factors influencing net worth and the overall financial success of individuals within that specific sector. Analyzing these facets provides a more nuanced perspective on the individual's financial position and potential. The intersection of industry-specific factors and an individual's actions forms a complex equation that determines financial success and the overall net worth.

Frequently Asked Questions about Aldo Ray's Net Worth

This section addresses common inquiries regarding Aldo Ray's financial standing, offering concise and informative answers. Publicly available data about an individual's net worth is often limited, and estimations vary. Therefore, the information provided here represents a compilation of available data and analysis.

Question 1: How is net worth calculated?

Net worth is determined by subtracting total liabilities (debts and obligations) from total assets (possessions with monetary value). Assets can include real estate, investments, and other holdings. Liabilities encompass loans, outstanding debts, and other financial obligations. Various valuation methods are employed for different asset types, and these methods can influence the calculated net worth.

Question 2: What factors influence an individual's net worth?

Several factors contribute to an individual's net worth. Income sources, both active and passive, play a critical role. Investment decisions and returns on those investments influence asset value. Financial decisions, such as debt management practices, also impact the net worth calculation. Industry context and the overall economic climate can also affect the potential for wealth accumulation.

Question 3: Is publicly available data on net worth always accurate?

Publicly available data regarding net worth is often an estimate. Accuracy varies depending on the source and method used for valuation. Estimates rely on available information, often reflecting assets and income but potentially omitting debts and liabilities. Verification of figures from various sources is essential for a comprehensive understanding.

Question 4: How does public perception impact perceived net worth?

Public perception can influence the perceived net worth of an individual. Positive media coverage, industry success, or social standing may contribute to a higher perceived value. Conversely, controversies or negative publicity can negatively impact this perception. It's crucial to differentiate between the perceived and actual net worth.

Question 5: Where can I find reliable information about net worth?

Reliable information about an individual's net worth is often limited. Publicly available financial data might be incomplete or require further analysis. Official financial statements, if available, provide a more comprehensive view. However, estimating net worth requires careful consideration of various factors. Therefore, rely on multiple sources and analyze the information critically before drawing conclusions.

In conclusion, understanding the factors that influence and calculate net worth provides a more thorough comprehension. Recognizing the limitations of publicly available data and critically evaluating different sources is vital to forming a well-rounded perspective.

Moving forward, this discussion can be extended to consider specific industries, asset types, and financial strategies to develop a more in-depth understanding.

Conclusion

This analysis explored the multifaceted concept of Aldo Ray's net worth, encompassing various factors impacting its estimation. Key considerations included the calculation methods for assets and liabilities, the role of income sources, investment strategies, and the influence of industry context and public perception. Understanding the complexities of valuation methods, the interplay of financial history, and the nuanced impact of public perception proved crucial in forming a comprehensive understanding. While accurate figures remain elusive without access to private records, the exploration highlighted the significant interplay of various elements in determining an individual's overall financial standing.

Accurate assessment of net worth necessitates a comprehensive approach, considering not only financial data but also the context of industry trends, economic conditions, and public perception. This comprehensive exploration underscores the inherent complexities in evaluating financial status. Further research, incorporating private records if accessible, would be necessary to establish a definitive evaluation of Aldo Ray's net worth. However, the analysis provides a framework for understanding the various contributing factors, offering valuable insights into the intricate dynamics of financial valuation.

Iconic George Burns Images: Hilarious & Memorable Moments

Jesse Watters Primetime Ratings Today: Latest Numbers Revealed

Roseane Cash: Secure & Reliable Funding Options